Portfolio Carbon Accounting

Strategic Advisory

backed by Tech

We solve our clients most challenging solutions

blending expert advisory and digital solutions

Contact Bloom about how we can help you from meeting your compliance obligations to capitalise on the low carbon economy

3 steps to reduce portfolio emissions

Challenges

Real emissions data is difficult to gather. There could be millions of data points.

You don’t know what to collect.

1

Start with proxy data

Output

Estimated finance emissions footprint by asset class (and sector, building type, etc).

Action

1. Identify portfolio emissions hotspots

2. Inform primary data collection strategy

2

Collect primary data

Output

Actual emissions footprint by asset class (and sector, building type, etc) collect at scale by source. Target high impact classes.

Action

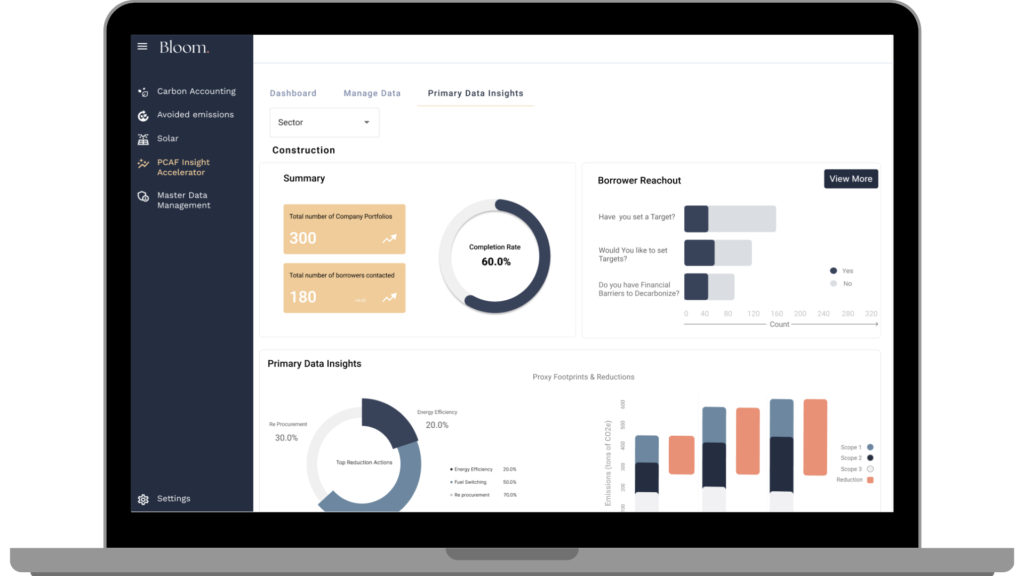

1. Measure and track high impact asset classes over time

2. Get asset class level information

3

Develop decarbonisation strategy

Output

A decarbonisation strategy tailored to your asset classes (i.e. borrowers).

Action

1. Confirm or set targets

2. Engage your portfolio for decarbonisation

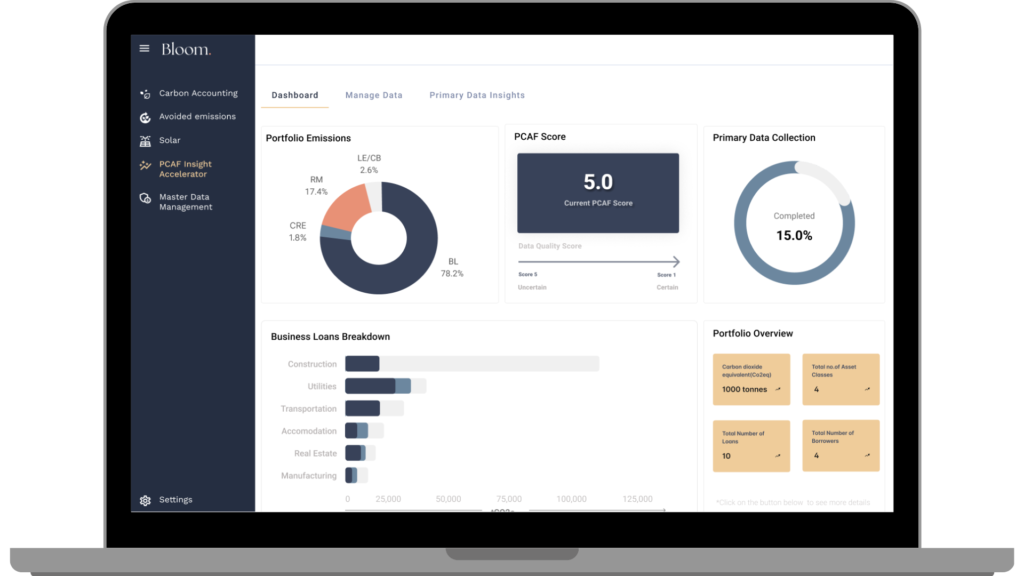

Many financial institutions are committing to frameworks and targets but don’t have tools that enable them to make informed decarbonisation decisions. Portfolio carbon accounting is complex, requiring measuring emissions in the assets you finance. Finance emissions often make up more than 90% of your carbon emissions, and measuring emissions across your asset classes is incredibly complex.

Our digital tools enable financial institutions to collect information – the primary or secondary data required to understand the hotspots in your portfolio and develop an informed decarbonisation strategy. This strategy could include unlocking new revenue streams by offering new products and services that enable low carbon actions in our portfolio.

Use proxy data to determine primary data collection. How we can help:

Proxy Data Assessments

With a proxy data assessment, we require limited data to estimate hotspots in your financed emissions portfolio.

A proxy data assessment will carry a higher score under PCAF, however it is a powerful tool to make an informed primary data collection strategy.

Primary Data Collection

Our digital tool allows you to customise your borrower outreach by asset class and sector – depending on where your hotspots are.

The Insight Accelerator will generate a customised list of questions that you can send (via a unique link) to your portfolio. The information is collected and sent back to the portal allowing you to gain borrower-level insights that feed into your decarbonisation strategy.

Our platform enables:

carbon accounting of your financed emissions portfolio

compliance with PCAF and the GHG Protocol

smart climate risk assessments and incentivisation

analysis of your Scope 3 emissions

climate leadership towards net-zero targets

Services:

● Carbon footprinting and hotspot analysis

● Decarbonisation strategy development

● Materiality assessment

● Target setting (SBTi, NZBA, etc)

● Carbon Offset and PPA procurement

● Project financing

● Carbon offset strategy

● Insetting

● Supply chain decarbonisation solutions

● TCFD, SFDR, CSRD compliance

● Sustainable finance solutions

“Bloom delivered a complex decarbonisation strategy for our U.S. operations”

Complex carbon accounting

for supply chains

Bespoke software module

for CSRD data capture

Decarbonisation strategy

for global publishing house

Pricing

Our pricing model is designed to be highly affordable and scalable with your business.

Get in touch to learn more.

Frequently asked questions

Learn more about Bloom works with companies here.

Contact us

to get started.

Read our thought leadership white papers:

Carbon Inset White Paper – September 2024

E-Waste White Paper – July 2024

Bloom ESG discuss how monetizing e-waste can enhance your bottom line while promoting sustainability. Explore…