Many financial institutions are committing to frameworks and targets but don’t have tools that enable them to make informed decarbonisation decisions. Portfolio carbon accounting is complex, requiring measuring emissions in the assets you finance. Finance emissions often make up more than 90% of your carbon emissions, and measuring emissions across your asset classes is incredibly complex.

Our digital tools enable financial institutions to collect information – the primary or secondary data required to understand the hotspots in your portfolio and develop an informed decarbonisation strategy. This strategy could include unlocking new revenue streams by offering new products and services that enable low carbon actions in our portfolio.

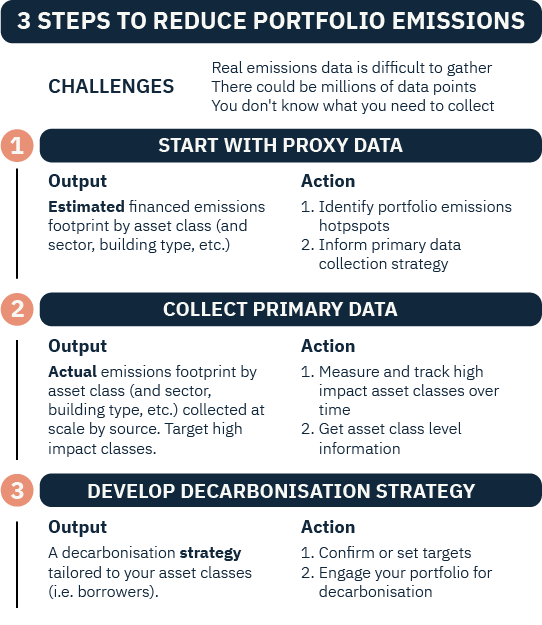

Use proxy data to determine primary data collection

How we can help

Proxy Data Assessments

With a proxy data assessment, we require limited data to estimate hotspots in your financed emissions portfolio.

A proxy data assessment will carry a higher score under PCAF, however it is a powerful tool to make an informed primary data collection strategy.

Primary Data Collection

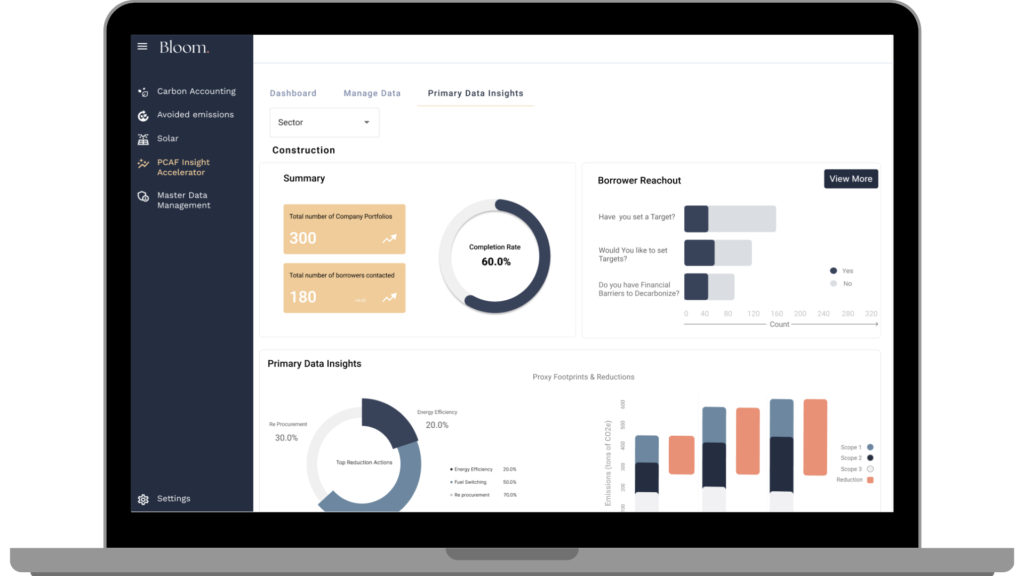

Our digital tool allows you to customise your borrower outreach by asset class and sector – depending on where your hotspots are.

The Insight Accelerator will generate a customised list of questions that you can send (via a unique link) to your portfolio. The information is collected and sent back to the portal allowing you to gain borrower-level insights that feed into your decarbonisation strategy.

Our platform enables:

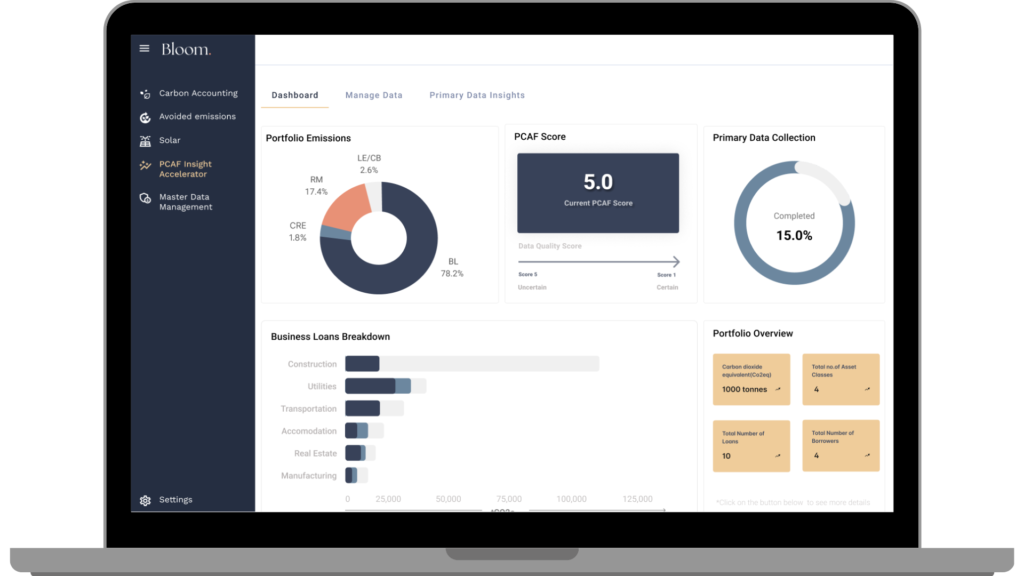

● carbon accounting of your financed emissions portfolio

● compliance with PCAF and the GHG Protocol

● smart climate risk assessments and incentivisation

● analysis of your Scope 3 emissions

● climate leadership towards net-zero targets

Get started today

We see sustainability as an opportunity for business and the planet.

Book a call and let’s talk about how we can implement a strategy for your business.

Contact us to get started.